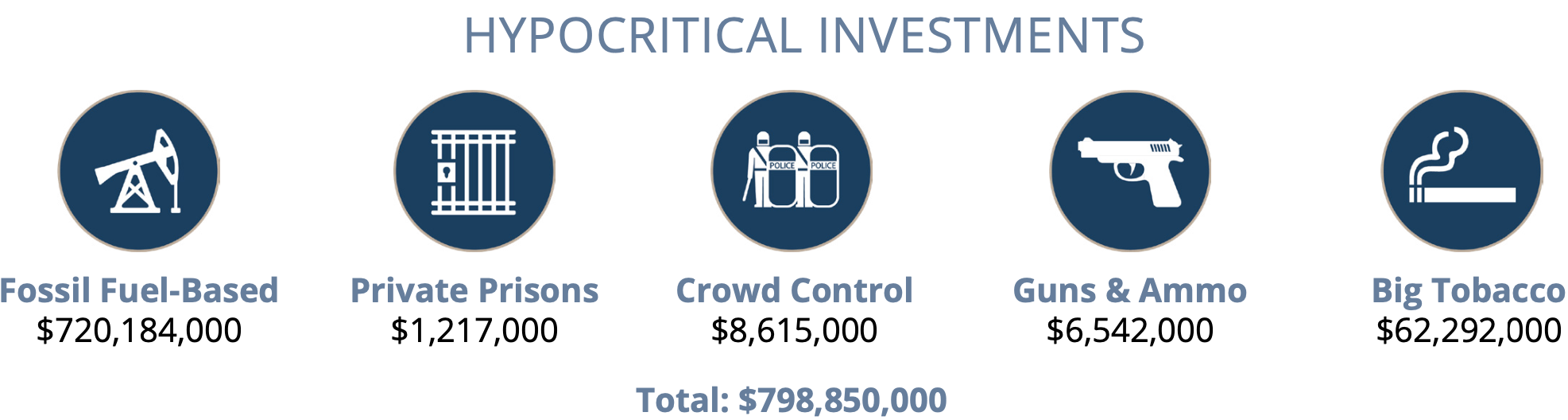

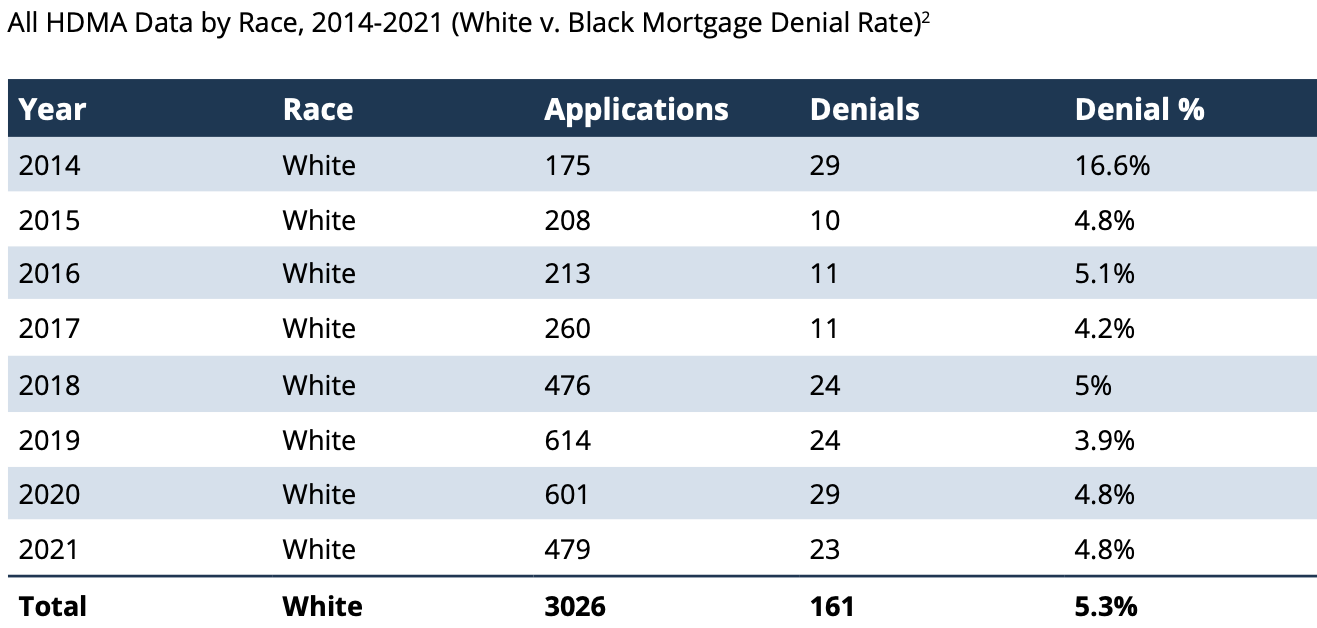

Two Times More Likely to Deny Black Applicants for Mortgages vs. White Applicants

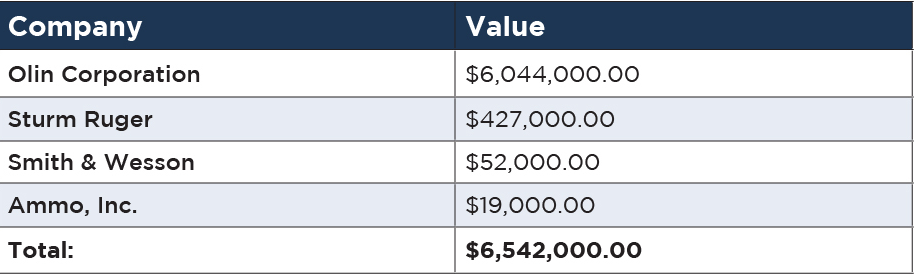

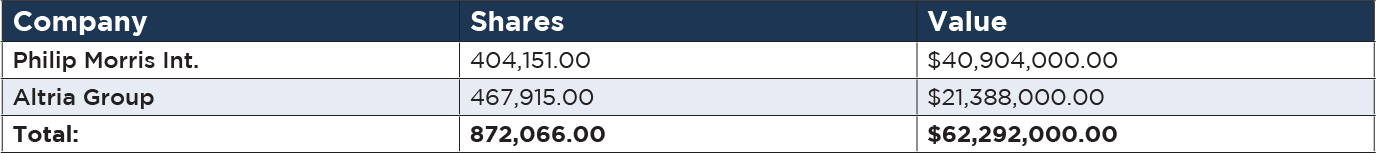

From 2014-2021, Amalgamated Bank’s average mortgage denial rate to Black applicants was over twice that of White applicants.

BLACK HMDA DENIAL RATES

WHITE HMDA DENIAL RATES

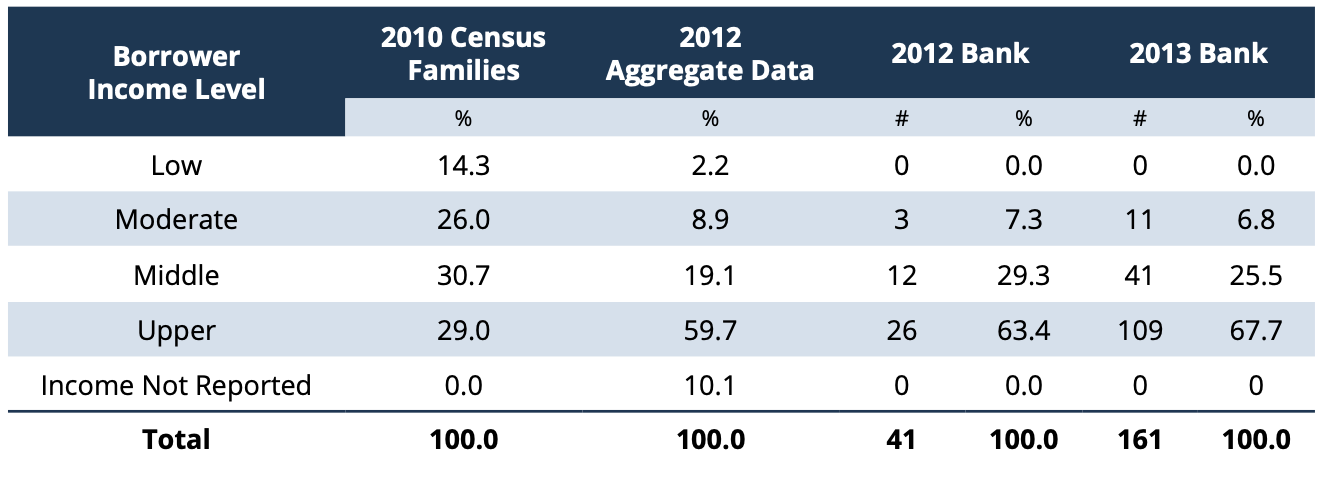

Poor Track Record on Mortgage Loans to Low-Income Borrowers

New York/New Jersey Metro Area

In 2011, 2012, and 2013, Amalgamated Bank failed to report any loans to low-income borrowers according to New York State's Community Reinvestment Act Performance Evaluation.

In 2013 and 2017, the evaluation rated Amalgamated Bank’s lending to low-and moderate-income borrowers as “Need to Improve.”

In 2018, Amalgamated Bank was assessed by the to have below-average lending to low- and moderate-income borrowers.

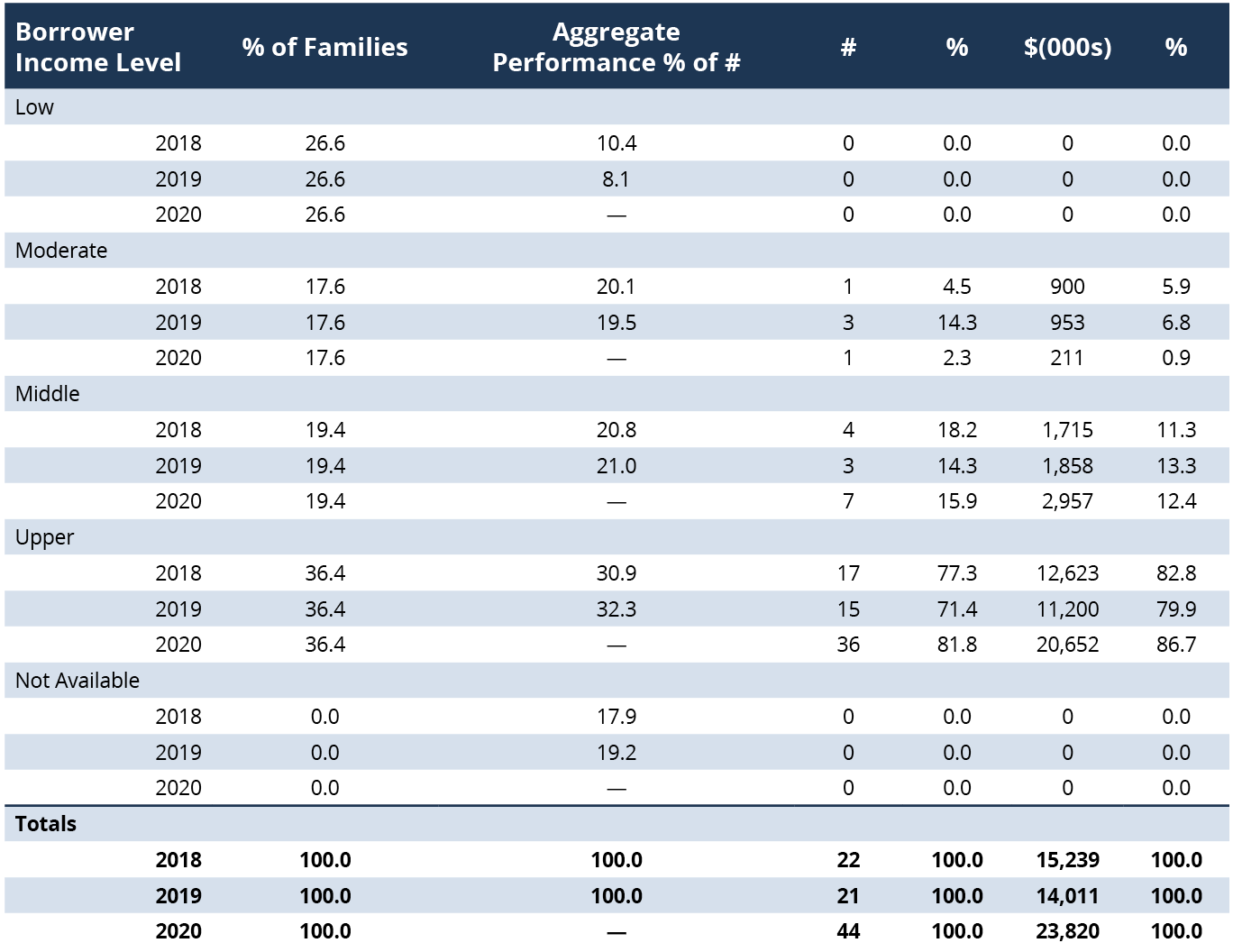

Washington DC Metro Area

In 2010, Amalgamated Bank only originated two 1-4 family loans and they were both to upper- income borrowers in the region.

In 2018, 2019, and 2020, Amalgamated Bank did not originate a single 1-4 family home mortgage loan to low-income borrowers in the region.

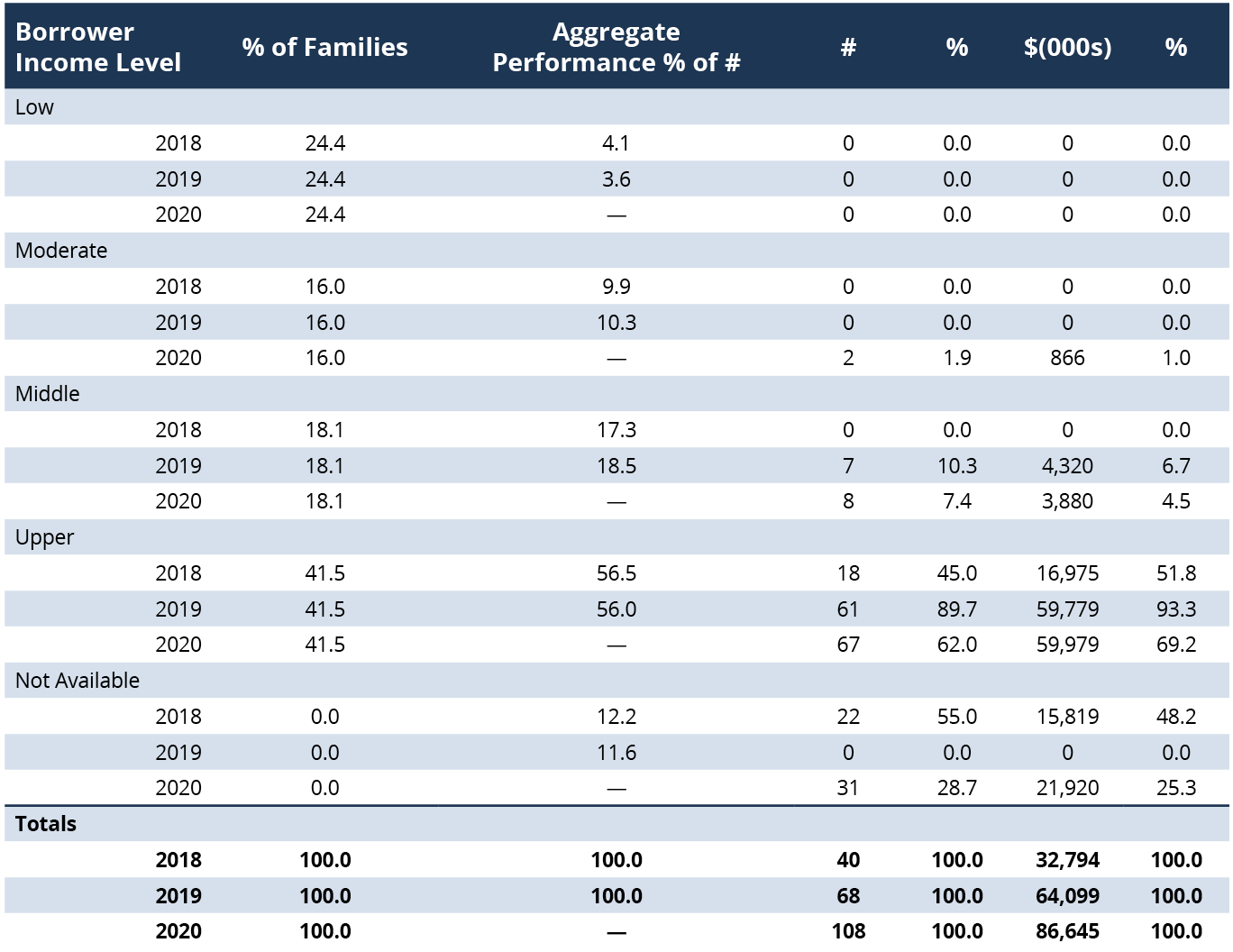

California

In 2014, Amalgamated Bank’s lending was rated as “substantial noncompliance” for failing to lend to low-income borrowers.

In 2018, 2019, and 2020, Amalgamated Bank failed to originate any 1-4 family loans among low- income borrowers.

Nevada

In 2014, Amalgamated Bank’s Nevada lending was deemed to be of “substantial noncompliance” for poor lending to low-and moderate-income borrowers.

Branch Closings and Poor Service to Low-Income Communities

Amalgamated Bank has shuttered locations in low-income or underserved communities and has been criticized for only having branches and ATMs in upper-income areas. This behavior led to a protest in a West Bronx neighborhood in New York City after Amalgamated closed its only branch in the area.